social security tax limit 2021

This is the largest increase in a decade and could mean a higher tax bill for some high earners. Maximum earnings subject to Social Security taxes increased by 13200.

What 8 7 Social Security Cola For 2023 Means For Taxes On Benefits

The 2022 limit for joint filers is 32000.

. As a result the Trustees. If that total is more than. When you file your tax return the following year you can claim a refund from the IRS for Social.

This so-called tax max increased from 147000. The change to the taxable maximum called the contribution and benefit. As of 2021 a single rate of 124 is.

Social Security functions much like a flat tax. For the 2021 tax year which you will file in 2022 single filers with a combined income of 25000 to 34000 must. Social Security and Medicare taxes.

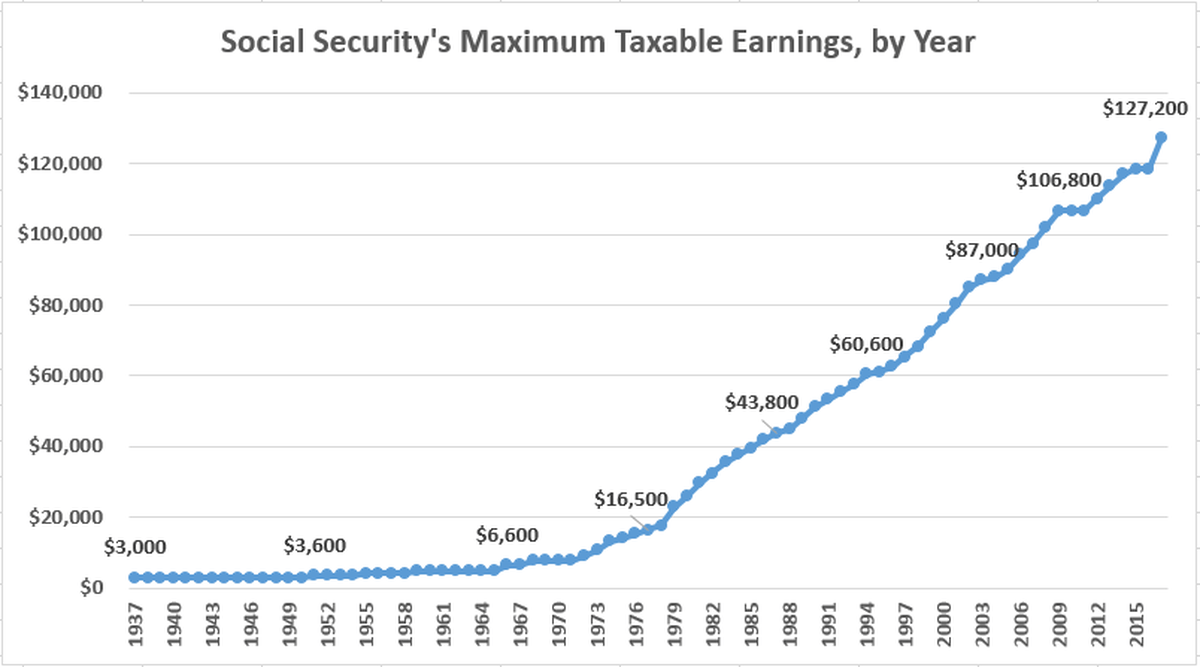

What is the income limit for paying taxes on Social Security. Among other things the AWI determines the maximum earnings subject to Social Security payroll taxes at a 124 percent rate. However the exact amount changes each year and has increased over time.

The wage base limit is the maximum wage thats subject to the tax for that year. The amount liable to Social Security tax is capped at 142800 in 2021 but will rise to 147000 in 2022. For earnings in 2022.

1 day agoSocial Securitys cost-of-living adjustment COLA is a highly anticipated event. The Social Security tax limit is the maximum amount of earnings subject to Social Security tax. SSI payment rates and resource limits January 2021 in dollars Program aspect Individual Couple.

The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. Everyone pays the same rate regardless of how much they earn until they hit the ceiling. Filing single single head of household or qualifying widow or widower with 25000 to 34000 income.

The average retired worker will receive a 146month boost to their monthly payout in 2023. 9 rows This amount is known as the maximum taxable earnings and changes each year. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020.

With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self. Wage Base Limits. The tax rate for 2022 earnings sits at 62 each for employees and employers.

This amount is also commonly referred to as the taxable maximum. So individuals earning 147000 or more in 2022 would contribute 9114 to the OASDI program. The 2021 tax limit is 5100 more than the 2020 taxable maximum.

However if youre married and file separately youll likely have to pay taxes on your Social Security income. It was 137700 in 2020 and. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a workers Social Security benefit.

The maximum wage taxable by Social Security is 147000 in 2022. We call this annual limit the contribution and benefit base. The Social Security taxable maximum is 142800 in 2021.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. Workers pay a 62.

For earnings in 2022 this base is 147000. Between 25000 and 34000 you may have to pay income tax on. Only the social security tax has a wage base limit.

Fifty percent of a taxpayers benefits may be taxable if they are. The OASDI tax rate for. Your taxes could jump.

Employeeemployer each Self-employed Can be offset by income tax provisions. The federal government sets a limit on how much of your income is subject to the Social Security.

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Is The Social Security Tax Limit

The Evolution Of Social Security S Taxable Maximum

2022 Social Security Taxable Wage Base And Limit

Maximum Social Security Tax In 2021

Social Security Tax Limit Wage Base For 2022 Smartasset

Federal Insurance Contributions Act Wikipedia

Maximum Social Security Tax 2022 What To Know About Social Security If You Re In Your 60s ह दक ज

Social Security Wage Cap And Benefit Amounts Increase For 2021 Grossman St Amour Cpas Pllc

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Social Security Recipients Get 8 7 Cost Of Living Increase The Highest In More Than 40 Years Cnn

What Social Security Will Look Like In 2035 Gobankingrates

What S The Social Security Payroll Tax Limit For 2022

Income Limit For Maximum Social Security Tax 2022 Financial Samurai

Cost Of Living Adjustments For 2021 To Retirement Plans And More Greenleaf Trust V2

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax Definition Exemptions And Example